Navigating the Fast Track: Get To New Heights With Our Streamlined Hard Money Loans

Are you all set to reach new heights with our streamlined tough cash fundings? With our fast authorization procedure, you can navigate the fast track to success. Discover the advantages of our effective system and how it can aid you take investment possibilities. In this post, we will certainly give ideas for a smooth car loan application and help you comprehend the difference in between hard cash car loans and conventional loans. Do not miss out on this possibility to take your financial future to brand-new heights.

The Benefits of Streamlined Hard Cash Loans

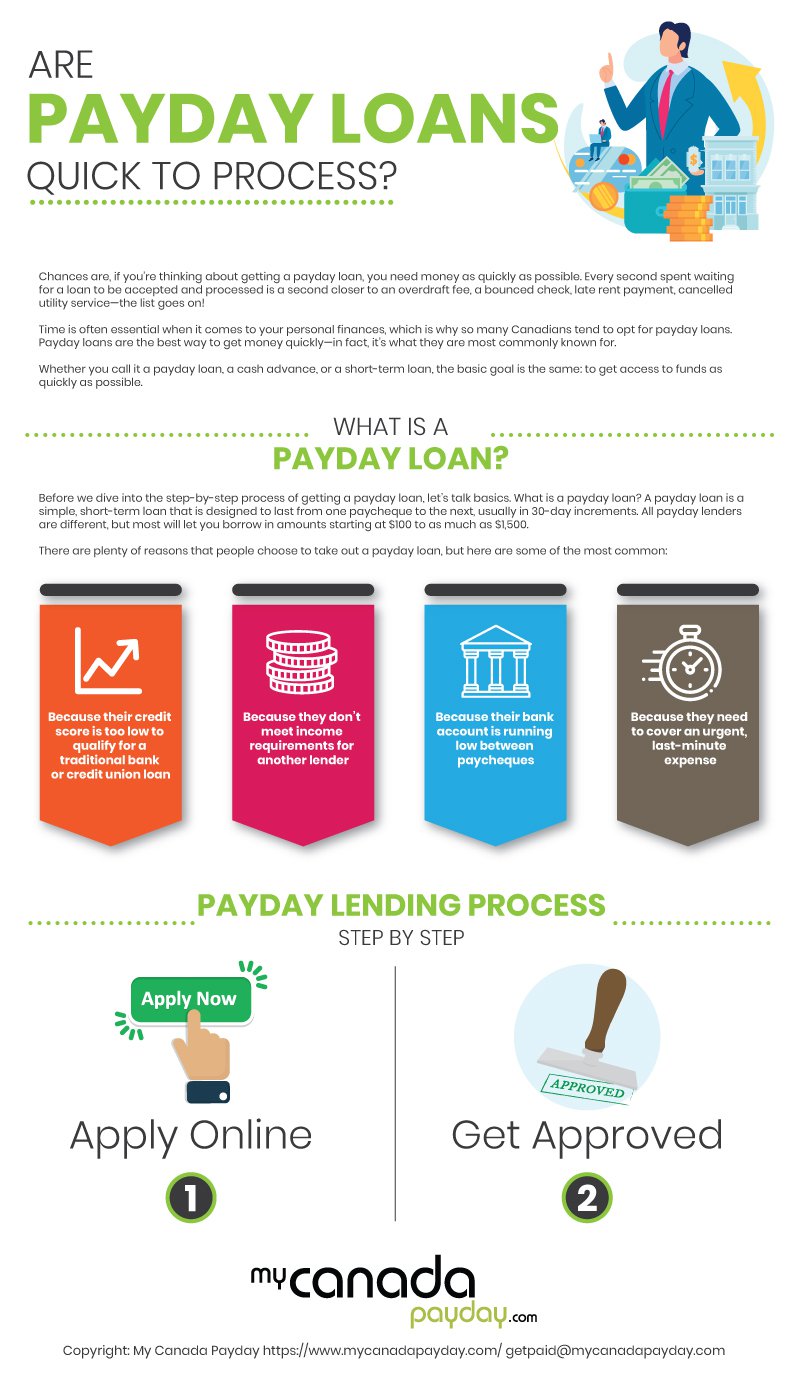

You'll love the benefits of our structured hard money finances. With our lendings, you can take pleasure in a fast and easy application procedure. Gone are the days of lengthy documents and awaiting weeks to get approved. Our structured process enables you to apply online and obtain a choice in just a few days. This implies you can obtain the financing you need faster and start servicing your task sooner.

Another great benefit of our streamlined hard cash fundings is the adaptable terms we use. Whether you require a short-term car loan or a longer repayment period, we have actually obtained you covered.

In enhancement, our structured difficult money lendings offer affordable rates of interest. We strive to offer our clients with the most budget-friendly financing options readily available. By keeping our rates reduced, we assist you conserve cash and maximize your return on investment.

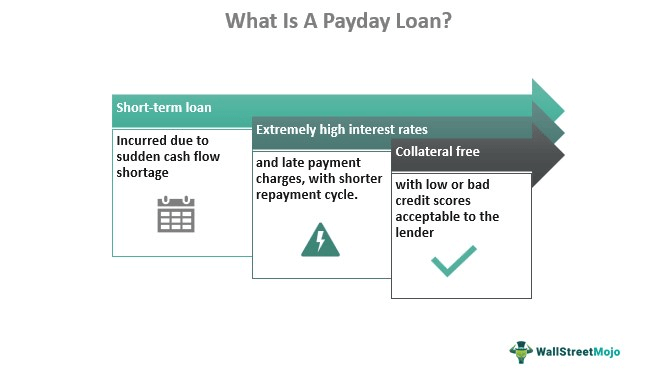

Last but not least, our structured hard cash finances included minimal requirements. We do not focus on your credit rating or economic history. Rather, we think about the worth of the property you're making use of as collateral. This makes it easier for you to get a car loan, also if you don't have an excellent credit report rating.

Exactly How Our Rapid Approval Process Can Assist You Reach New Levels

That's why our structured hard money car loans are made to give you fast accessibility to the funds you require. With our rapid authorization procedure, you can bypass the lengthy paperwork and unlimited waiting that commonly comes with typical lendings.

Picture this: you have a golden chance to invest in a property that has the potential to yield considerable returns. To confiscate this possibility, you require funding, and you need it quickly. That's where our quick authorization procedure is available in. We comprehend that timing is important worldwide of property, and we don't desire you to lose out on any lucrative bargains.

With our lightning-fast approval process, you can send your loan application and obtain a choice in record time. Say goodbye to waiting weeks and even months for a response. We make every effort to supply you with a seamless experience that permits you to relocate forward with your strategies without delay.

Whether you're a seasoned capitalist or just beginning out, our fast authorization process can aid you achieve your financial objectives. Take the first action towards getting to brand-new heights and use for our streamlined difficult money car loan today.

Browsing the Fast Track: Tips for a Smooth Loan Application

Think of applying for a funding and efficiently browsing the rapid lane with these helpful tips. When it comes to protecting a finance, time is of the significance, and you want the process to be as seamless as feasible.

Following, do your research and research various lending institutions. Search for reputable firms that concentrate on rapid authorization fundings. hard money lender atlanta. Review testimonials, contrast passion prices, and inspect their navigate to this website loaning requirements. This will help you pick the most effective lender that matches your demands and makes sure a smooth application procedure.

Understanding the Difference: Hard Cash Loans Vs. Typical Car Loans

Exactly How Our Streamlined Process Can Help You Confiscate Financial Investment Opportunities

Our streamlined procedure can help you in taking advantage of investment possibilities. With our structured method, we make it easier than ever before for you to take the possibility to expand your riches. Gone are the days of difficult documentation and extensive authorization processes. We recognize that time is important when it involves spending, and that's why we have actually created our system to be effective and fast.

From the minute you send your application, our group of specialists delves into activity, functioning faithfully to examine your info and provide you with a choice in a prompt manner. We value your time and strive to continue reading this make the procedure as uncomplicated as possible, allowing you to concentrate on what really matters-- making profitable financial investments.

When approved, we throw away no time in getting the funds to you. Our quick financing system makes sure that you have the capital you require to make use of financial investment chances as quickly as they emerge. Whether you're wanting to expand your genuine estate portfolio or purchase an appealing startup, our streamlined process will certainly help you browse the fast track and get to new elevations in your investment trip.

Verdict

So, if you're seeking to reach brand-new elevations with your investments, our structured difficult money loans are your ticket to success. With our rapid approval procedure, you can swiftly seize financial investment opportunities and browse the fast track of actual estate. Do not let standard fundings slow you down-- select our hard cash lendings and experience the advantages of a streamlined procedure. Take the plunge and raise your investments today!

In this article, we will certainly provide suggestions for a smooth car loan application and aid you understand the distinction in between hard money financings and standard lendings.Recognizing the difference in between tough money fundings and typical car loans can aid you make informed decisions regarding your funding alternatives. The authorization process for tough cash loans is typically quicker and much less stringent compared to conventional fundings (hard money lender atlanta). It's vital to carefully consider your particular financial requirements and scenarios when determining in between a tough cash financing and a traditional lending. Don't let conventional car loans slow you down-- choose our hard money car loans and experience the benefits of a streamlined procedure